Walmart Stock Analysis: What Investors Should Know in 2025

Investor attention has recently been drawn to Walmart Inc.’s (NYSE: WMT) latest earnings report and its outlook for the future. As one of the largest global retailers, Walmart’s performance plays a key role in shaping investor sentiment. In this analysis, we’ll dive into Walmart's most recent financial results, stock performance, and its strategic initiatives to help investors understand what lies ahead.

Walmart’s Latest Earnings Report: Key Takeaways

On February 20, 2025, Walmart released its Q4 earnings for the 2025 fiscal year. The company reported adjusted earnings per share (EPS) of $0.66, surpassing Wall Street's expectation of $0.64. Revenue reached $180.55 billion, exceeding forecasts of $180.31 billion. Notable growth was observed in several areas:

- Comparable U.S. sales grew by 4.6%.

- Global e-commerce sales saw a significant increase of 16%.

- Global advertising revenue surged by 29%, reflecting Walmart's growing strength in digital marketing. (Source: investors.com)

Despite these positive figures, Walmart provided a more cautious outlook for the first quarter (Q1) and the entire fiscal year 2026. For Q1, the company expects revenue growth of 3% to 4% and adjusted EPS between $0.57 and $0.58, which is lower than the market consensus of $0.64. For the full year, revenue growth is projected at 3.5% to 5.5%, with adjusted EPS expected to range between $2.50 and $2.60—in line with analysts’ expectations of $2.49. (Source: investors.com)

Stock Performance and Market Reaction

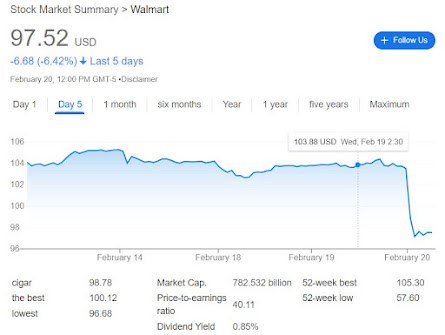

Following the earnings report, Walmart's stock price experienced a decline. As of February 20, 2025, shares fell by 6%, settling at $97.38. This drop was attributed to investor concerns over the company’s more conservative earnings guidance and the potential for slower growth in the near term. (Source: investopedia.com)

Why Walmart’s Stock Fell

Walmart’s stock dropped primarily due to lower-than-expected earnings forecasts. Investors became concerned about the company’s future growth amid rising costs and potential risks like tariffs.

However, some analysts remain bullish on Walmart’s prospects. For example, Morgan Stanley has set a target price of $150 for Walmart’s stock, citing strong profit margins and the efficiency gains expected from continued investments in e-commerce and retail media. The growth of Walmart+ memberships and the expansion of digital advertising revenue are seen as key drivers for the company's continued success. (Source: investopedia.com)

Walmart’s Strategic Focus: What Lies Ahead

Walmart’s future performance will largely depend on how effectively it adapts to changing economic conditions. In 2024, the company capitalized on its competitive pricing strategy, attracting budget-conscious consumers amidst ongoing inflationary pressures. However, challenges lie ahead as we move into 2025:

- Declining consumer spending could impact sales growth.

- Rising costs due to tariffs on Chinese imports might squeeze profit margins.

These challenges could create additional pressure on Walmart's low-cost business model. However, Walmart's strong grocery segment and growing base of high-income consumers could help buffer against these headwinds. Additionally, the company’s continued focus on digital advertising and expanding its e-commerce platform is expected to offset potential declines in non-grocery sales.

CEO Doug McMillon has expressed confidence in the company’s momentum and its inventory management, but he remains cautious about potential risks posed by new tariffs and the broader economic environment. (Source: apnews.com)

2025 Walmart Stock Outlook

Analysts predict that Walmart may experience a slow recovery in 2025, with challenges from inflation, supply chain issues, and competition. However, if it can improve its digital growth and manage costs effectively, it might stabilize its performance.Key Factors to Consider Before Investing in Walmart Stock

Before making any investment decisions related to Walmart, investors should take into account the following factors:

Competitive Pricing and Value Proposition: Walmart's ability to offer low prices is a major strength, attracting a diverse customer base across various income segments.

Growth in E-Commerce & Digital Advertising: The company’s investments in online shopping platforms and digital advertising are expected to be significant growth drivers moving forward.

Global Economic Conditions: Ongoing global challenges such as inflation, tariffs, and macroeconomic uncertainty could influence Walmart's cost structure and profit margins.

Intensifying Competition: With rivals like Amazon, Target, and other e-commerce giants, Walmart faces strong competition that could influence its market share and pricing strategies.

Walmart Stock Investment Strategy

Given the current market volatility, a cautious approach is recommended for Walmart stock. Long-term investors may want to wait for clearer signals of growth before committing. Diversifying into other retail stocks, like Amazon or Target, could also reduce risks.Conclusion: Walmart’s Evolving Business Model and Outlook

Walmart’s transformation from a traditional brick-and-mortar retailer to a diversified business, focused on e-commerce and digital advertising, is reshaping its long-term strategy. While the latest earnings report shows robust growth in several areas, the company’s conservative guidance indicates potential short-term challenges.

For investors, it’s crucial to weigh Walmart's current stock performance, its growth prospects in e-commerce, and the broader economic factors that could impact its future performance. Walmart’s continued emphasis on competitive pricing, its strong grocery division, and the expansion of Walmart+ and digital services will likely play a pivotal role in driving long-term value.

Walmart Stock Latest News

- Morgan Stanley Predicts Walmart Stock Could Reach $150 – Here's Why

- Walmart Stock Falls on Soft Outlook, But Analysts See Long-Term Potential

- Walmart's Success in 2024 Faces Challenges in 2025

Comments

Post a Comment